After you meet certain vesting criteria, your SERS membership entitles you to receive a pension payment every month for as long as you live. The amount of the payment is determined by a formula set forth in the Retirement Code that takes into account your class of service multiplier, number of years of credited service, and final average salary.

Your SERS pension does NOT determine if or how much you may be paid for accumulated leave when you retire, offer retiree health insurance coverage, or include automatic cost of living adjustments after you retire.

The monthly payment you will receive from your SERS benefit is not influenced by how much your employer contributes or the performance of the SERS investments. It will, however, be reduced if you choose to retire before the SERS normal retirement age specified by your class of service.

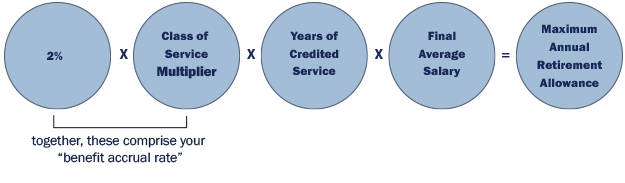

The pension formula is:

Your class of service is determined largely by when you were hired and the work that you do. In most cases, your class of service will be determined by when you were first hired as a state employee. If you leave state service and later return, it is very important that you let your HR office know.

Your class of service multiplier x 2% equals your benefit accrual rate. This is one of the most common sources of confusion about SERS' pension benefits. In short hand, people will often say, "I have a 2.5% multiplier." In fact, the law provides a class of service multiplier of 1.25 that, when plugged into the formula and multiplied by 2%, yields a benefit accrual rate of 2.5%.

You are credited with one year of service when you work 1,650 hours or more in a calendar year. If you work less than 1,650 hours, you are credited with a fraction of a year equal to the number of hours you worked divided by 1,650.

In addition to earning service credit in your current job, you may be able to increase your years of credited service - and, thus, increase your pension - by purchasing service associated with time you worked in certain other jobs.

Your final average salary is the highest amount you earned during any "three non-overlapping periods of four consecutive calendar quarters." For most employees, it is the average of your last three years' salary.

Let's say...

You have earned 25 years of credited service

Your final average salary is $50,000

You are retiring at age 60, so there is no early retirement reduction

You contributed 6.25% of every paycheck to SERS, which has been credited with 4% annually

The pension formula would be...

2% x 1.25 x 25 x 50,000

Your maximum annual retirement allowance would be...

$31,250

Once your maximum annual retirement allowance is calculated, SERS determines how much your actual monthly payment will be based on a variety of factors, including the monthly payment option you select when you retire.